A BLS E-Services IPO will open soon, with the gray market premium operating at the edge, or above 100%. This implies that if you receive an allotment, the gray market premium will operate by the price, meaning that the money will be 100%. There is a full doubling chance. IPO is now known as BLS E-Services. These are some crucial details for you to be aware of, most notably the fact that the entire IPO will include a shareholder quota. I’ll go over the crucial details with you as well.

The Rs 310.91 crore BLS E-Services IPO is a book-built offering. This is a completely new 2.3 crore share offering.

The subscription period for the BLS E-Services IPO begins on January 30, 2024, and ends on February 1, 2024. On Friday, February 2, 2024, the allocation for the BLS E-Services IPO is anticipated to be completed. Tuesday, February 6, 2024, has been set as the tentative listing date for the BLS E-Services IPO on the BSE and NSE. The price range for BLS E-Services’ IPO is ₹129 to ₹135 per share. 108 Shares is the minimum lot size required for an application. Retail investors are required to invest a minimum of ₹14,580. For both sNII and bNII, the minimum lot size investment is 69 lots (7,452 shares), or ₹1,006,020, and 14 lots (1,512 shares), or ₹204,120.

Refer to BLS E-Services IPO RHP for detailed information.

BLS E-Services company overview

The technology-enabled digital service provider BLS-E Services Limited offers the following services: (i) Business Correspondent services to major Indian banks; (ii) Assisted E-services; and (iii) E-Governance Services at the local level in India. In addition to a variety of B2C services to residents in urban, semi-urban, rural, and remote areas, they offer access points for the delivery of vital public utility services, social welfare programs, healthcare, financial, educational, agricultural, and banking services for governments (G2C) and businesses (B2B).

At the moment, its retailers are divided into two groups: BLS Touchpoints and BLS Stores. Every merchant that has registered with the business is regarded as a BLS Touchpoint and can offer a variety of services that we provide. BLS Stores are stores bearing the BLS name that provide their full range of services to customers. This includes the sample selection of products from e-commerce companies that may be ordered and obtained by customers after they have had a chance to touch and feel them. They will have 1,016 BLS Stores among their 98,034 BLS Touchpoints as of September 30, 2023.

Brokerage Firm BLS E-Services IPO Review apply or not.

Here are the top brokerage firms and their Review of BLS E-Services IPO

- Anand Rathi: Apply

- BP Equities: Apply

- Canara Bank Securities: Apply

- Marwadi Shares and Finance: Apply

- Reliance Securities: Apply

- Swastika Investmart: Apply

- Ventura Securities: Apply

BLS E-Services IPO Details

| IPO Date | January 30, 2024 to February 1, 2024 |

| Listing Date | February 6, 2024 |

| Face Value | ₹10 per share |

| Price Band | ₹129 to ₹135 per share |

| Lot Size | 108 Shares |

| Total Issue Size | 23,030,000 shares (aggregating up to ₹310.91 Cr) |

| Fresh Issue | 23,030,000 shares (aggregating up to ₹310.91 Cr) |

| Issue Type | Book Built Issue IPO |

| Listing At | BSE, NSE |

| Share holding pre issue | 66,726,485 |

| Share holding post issue | 66,726,485 |

BLS E-Services IPO Timeline

BLS E-Services IPO opens on January 30, 2024, and closes on February 1, 2024.

| IPO Open Date | Tuesday, January 30, 2024 |

| IPO Close Date | Thursday, February 1, 2024 |

| Basis of Allotment | Friday, February 2, 2024 |

| Initiation of Refunds | Monday, February 5, 2024 |

| Credit of Shares to Demat | The credit of Shares to Demat |

| Listing Date | Tuesday, February 6, 2024 |

| Cut-off time for UPI mandate confirmation | 5 PM on February 1, 2024 |

BLS E-Services IPO Lot Size & Application Detail

| Retail (Min) | 1 | 108 | ₹14,580 |

| Retail (Max) | 13 | 1404 | ₹189,540 |

| S-HNI (Min) | 14 | 1,512 | ₹204,120 |

| S-HNI (Max) | 68 | 7,344 | ₹991,440 |

| B-HNI (Min) | 69 | 7,452 | ₹1,006,020 |

BLS E-Services IPO Promoter Holding

| Share Holding Pre-Issue | 93.80% |

| Share Holding Post Issue | 68.90% |

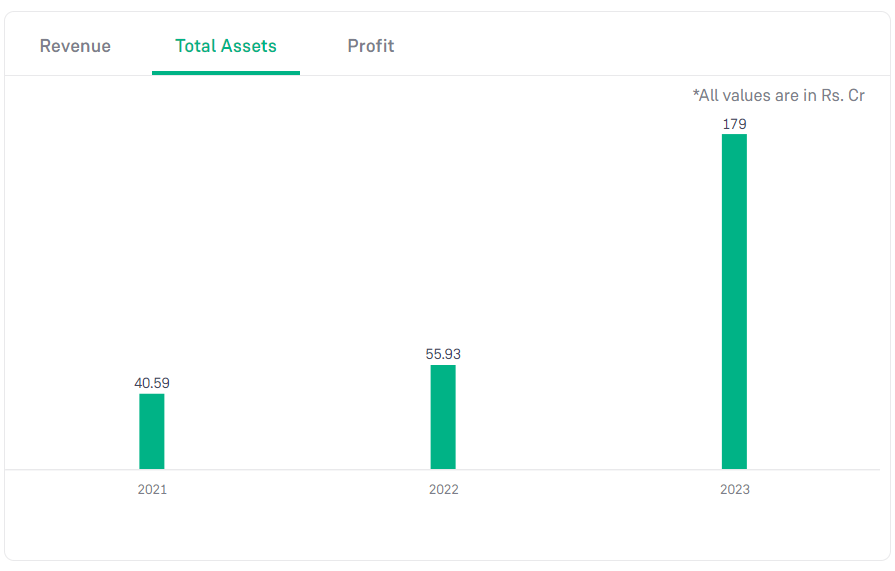

BLS E-Services IPO Financials

Also Read:10 Best Investment Options in India to Get High Returns in 2024

BLS E-Services IPO FAQs

When BLS E-Services IPO will open?

The BLS E-Services IPO opens on January 30, 2024, and closes on February 1, 2024.

What is the lot size of the BLS E-Services IPO?

BLS E-Services IPO lot size is 108 Shares, and the minimum amount required is ₹14,580.

When is the BLS E-Services IPO allotment?

Allotment for BLS E-Services IPO will be done on Friday, February 2, 2024, and the allotted shares will be credited to your demat account by Monday, February 5, 2024.