If you Looking for the Best Investment Options in India for the next 10 years here are some suggestions for you Mutual funds, fixed deposits, the national pension system, stock investments, commercial real estate, bonds, initial public offerings (IPOs), mutual funds, and other investment opportunities are among the top choices for 2024 in India.

The best way to increase your wealth in India is to invest. In doing so, you can stave off price increases, accomplish your financial objectives, and secure a comfortable retirement. Put your money to work for you by investing in stocks, shares, mutual funds, and fixed deposits rather than just leaving it in the bank.

3 Types of Risk Involved in Investment Options in India

1. Low-Risk Investments: By making low-risk investments, you can get stability and guaranteed profits. Options such as the Public Provident Fund (PPF), Sukanya Samriddhi Yojana, and Fixed Deposits are designed for people who value security above all else. They offer a strong foundation of consistent returns. With confidence, navigate the financial world, ensuring that your money grows safely as well.

2. Investments with a medium level of risk are marginally riskier than those with a low level of risk. They fit the bill for investors seeking a well-rounded portfolio. Debt funds, corporate bonds, and government bonds are examples of medium-risk investments that offer a balance between risk and return.

3. Usually related to the market, high-risk investments carry a greater degree of risk. These investments have a high degree of volatility and unpredictability, even with the possibility of higher future returns. High-risk investments include stocks, mutual funds, and unit-linked insurance plans; these are appropriate for investors who can tolerate a higher level of risk in exchange for a higher return.

List of Investment Options in India

| Investment Options | Brief or Description | Return Level | Risk Level |

| Direct Equity | Buying a share of any company listed on market like BSE or NSE | High | High |

| Mutual Funds | Mutual Funds allow you to compare the funds based on different metrics, such as level of risk, return, and price. | High | High/Low |

| Public Provident Fund (PPF) | Traditionally considered to be among the best and safest investment modes in India, PPF is one of the most popular small savings schemes. | fixed depend on interest-rated | Low |

| National Savings Certificate (NSC) | the National Savings Certificate (NSC) is a fixed-income investment scheme that you can open easily with any post office. | fixed depend on interest-rated | Low |

| Bank FD (Fixed Deposit) | Bank FD is extremely popular in India. | fixed depend on interest-rated | Low |

| Real Estate Investment | Investment in real estate is one of the most lucrative and beneficial in India | High | High |

| GOLD | fixed depend on interest-rated | High | Low |

| Senior Citizen Savings Scheme (SCSS) | The SCSS is a government-backed scheme specifically for investors over 60. | fixed depend on interest-rated | Low |

| RBI taxable bonds | These bonds are safe and secure and offer assured returns over the tenure | fixed depend on interest-rated | Low |

| National Pension Scheme | It is a government-organized pension product for the employees of all the sectors in India | fixed depend on interest-rated | Low |

Detail Explanation of Best Investment Options in India

1. Direct Equity

One of the most well-liked investing options in India is stocks or Direct Equity. Investors searching for profitable long-term opportunities favor it. It’s crucial to remember that stock investing entails risk, so you should only invest if you have a thorough understanding of the market. Before investing in stocks, you as an investor should conduct thorough research.

Different stock types exist, such as value stocks and growth stocks. You can filter all of these stocks based on important metrics like market capitalization, net profit, etc. You need to be aware of the management, market conditions, industry the stock is in, etc.

2. Mutual Funds

A mutual fund is an investment pool that is professionally managed by a fund manager.

It is a trust that combines money from multiple people with similar investing goals and uses those funds to buy stocks, bonds, money market instruments, and/or other securities. By computing a scheme’s “Net Asset Value,” or NAV, the income/gains from this collective investment are dispersed proportionately among the investors following the deduction of any applicable costs and levies. A mutual fund is, in essence, the money that many people have contributed together.

Here’s a quick explanation of what a mutual fund unit is.

Assume that a box of twelve chocolates costs ₹40. Four friends choose to purchase the same item, but the merchant only sells by the box, and they only have ₹10 between them. The pals then resolve to purchase the box of 12 chocolates by pooling their ₹10 each. They now each get three chocolates, or three units if you were to compare it to mutual funds, based on their participation. And how is the price of a single unit determined? Just divide the entire sum by the total quantity of candy: 40/12 = 3.33. Thus, the first investment of ₹10 would result from multiplying the number of units (3) by the cost per unit (3.33).

As a result, every friend becomes a unit holder in the chocolate box that they all jointly own, making everyone a partial owner of the box.

3. Public Provident Fund (PPF) | one of the Best Investment Options in India

When the National Savings Institute of the Ministry of Finance launched the Public Provident Fund (PPF) in 1968, its goal was to raise small contributions for investment and profit. It is also known as an investment vehicle that lowers annual taxes while allowing one to save money for retirement. A PPF account should be opened by anyone searching for a secure investment choice that will reduce taxes and provide assured returns.

The Public Provident Fund, or PPF, is known as a great investment choice, particularly for those who are risk-averse. Because they are dependent on the market, the returns might not be extremely great, but they do provide stability. Investing in PPF offers tax advantages in addition to portfolio diversification.

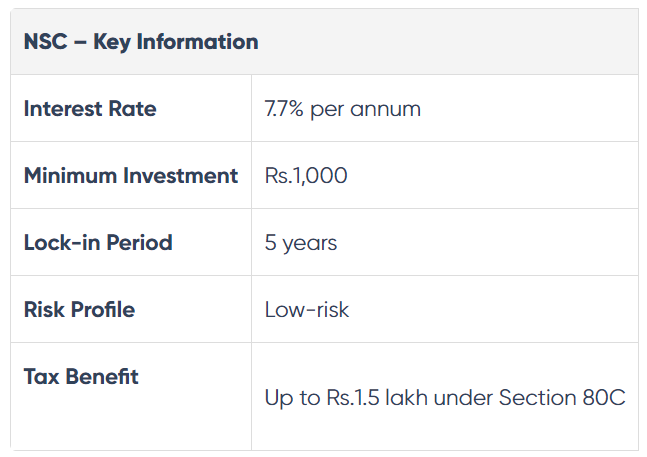

4. National Savings Certificate

National Savings Certificate is a savings bond program that allows participants, who are mostly low to medium-income investors, to save on income tax in Section 80C.

If you are looking for a secure way to invest your money earn regular interest and save on tax costs can invest in NSC. NSC provides guaranteed interest as well as total capital security. Like most fixed-income schemes, it is not able to offer the same inflation-beating returns as mutual funds that save taxes as well as the National Pension System.

The government has marketed its National Savings Certificate as a savings program for individuals. This is why Hindu Undivided Family (HUFs) as well as trusts can’t put money into the NSC. Additionally, even those who are not resident Indians (NRI) are not able to buy NSC certificates. This scheme is only available to individual Indian residents.

5. Bank FD (Fixed Deposit) | one of the safest and Best Investment Options in India

Investing in fixed deposits, which allow you to save money and receive a sizable interest rate, is one of the best ways of protecting your money. Over a certain term, competitive bank-fixed deposit (FD) interest rates enable the depositor to obtain a strong return on their investment. When opening an account, the depositor makes a single payment under the fixed deposit plan. The bank, the size of the deposit, and the tenure you select all affect the interest rates you’re provided.

The full amount is returned to the depositor after the duration once the interest has been calculated on the principal amount. Fixed deposits have terms ranging from 7 days to 10 years.

Different Banks Provide Attractive Interest Rates

Bank FD Interest Rates in India 2024 – Regular & Senior Citizen Rates

Generally, the interest rates offered by banks are a bit higher than those that are accessible to the general public. To obtain a senior citizen account and access the associated benefits, it is required to confirm age. Transferred from the savings account to the fixed deposit account are the deposited funds. It is commonly referred to as a sweep-in, sweep-out fixed deposit. This Scheme allows the depositor of the savings account to benefit from high-interest rates.

Tenure of the Deposit: Deposits with shorter tenure are often offered a lower rate of interest than those having a longer tenure. For Example, the highest FD interest rate offered by SBI Bank FD on a 1-year FD is 6.50% whereas for a 5-year FD, it offers 7.50%

6. Real Estate Investment

A profitable and rewarding investing approach is buying and holding real estate. Prospective real estate owners, when compared to stock and bond investors, might utilize leverage to purchase a property by paying a fraction of the total cost upfront and then gradually repaying the remaining balance, plus interest.

An investment that is sound has a good chance of being successful or a return on your investment. If your investment carries the risk of a large amount it should be offset with a substantial potential reward. Even if you select investment options with a high likelihood of achieving your goals there is no assurance. Don’t invest your money in real estate, or any other type of investment, if you can’t afford to lose the money then it is one of the Best Investment Options in India.

7. Investment in Gold

Although there are many different kinds of precious metals, gold is highly valued as an investment. Gold is one of the most favored investment options in India because of some influencing variables, including its high liquidity and ability to overcome inflation. Purchasing jewelry, coins, bars, gold exchange-traded funds, gold funds, sovereign gold bond schemes, and other items are just a few ways to invest in gold.

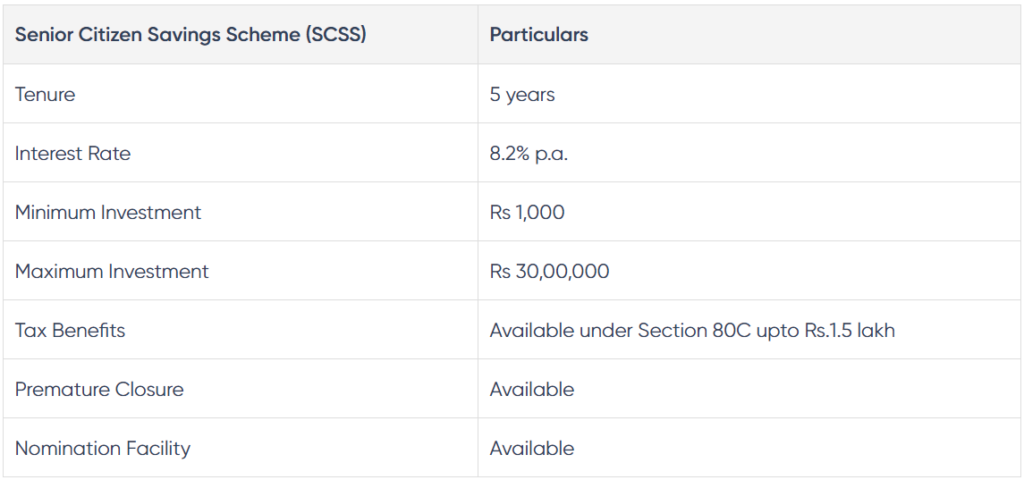

8. Senior Citizen Savings Scheme (SCSS)

A retirement benefits program supported by the government is called a Senior Citizens’ Savings Scheme (SCSS). Indian seniors who live in retirement can contribute a lump sum to the scheme either individually or jointly, and they will receive tax benefits in addition to regular income. A Post Office savings plan is involved. To receive the benefits of the SCSS, senior citizens must first open a SCSS account. They can open an account at any approved bank or Post Office branch.

Senior Citizen Savings Scheme (SCSS) in few points

- Minimum deposit ₹1000/- & in the multiples thereof with a maximum deposit of ₹30 lacs.

- An individual who has attained the age of 60 years or above on the date of opening of an account or an individual who has attained the age of 55 years or more but less than 60 years and has retired under Superannuation, VRS, or Special VRS, can open an account.

- Retired personnel of Defence Services (excluding Civilian Defence Employees) may open an account upon attaining the age of fifty years subject to the fulfillment of other specified conditions.

- A depositor may open an account individually or jointly with a spouse.

- Interest shall be payable from the date of deposit to 31st March/ 30th June/30th September/31st December on 1st working day of April/July/October/January as the case may be, in the first instance and thereafter, interest shall be payable on 1st working day of April/July/October/January.

- The account can be closed after the expiry of 5 years from the date of opening of the account.

- The depositor may extend the account for a further period of 3 years.

- Premature closure is permissible subject to certain conditions.

- Deposits in SCSS qualify for deduction u/s 80-C of the Income Tax Act.

9. RBI taxable bonds

One of the safest and Best Investment Options in India RBI Tax-saving bonds are financial instruments that are issued by public sector organizations or government bodies to raise money from the general public for particular objectives. These bonds are intended to encourage savings and investment in the economy while offering investors tax advantages.

Generally, tax-saving bonds provide tax exemptions or deductions for the bond’s investment or interest. The government typically uses the money obtained through tax-saving bonds to fund particular infrastructure or economic initiatives. These initiatives may deal with power, roads, trains, irrigation, housing, and other things.

Eligibility to invest in RBI Bonds

- An individual who is not a Non-Resident Indian (i.e. they must be a citizen of India):

- In an individual capacity;

- In an individual capacity on Joint Basis;

- In an individual capacity on anyone or survivor basis – wherein the event of death, the bond can be sold back to the original issuer;

- On behalf of a minor by the father/mother/legal guardian;

- A Hindu Undivided Family;

- A “Charitable Institution” registered under the 25th Section of the Indian Companies Act of 1956;

- An institution which has obtained a Certificate of Registration as a charitable institution by a law in force in the Republic of India;

- Any institution which has obtained a certificate from the Income Tax Authority for the purposes of Section 80G of the Income Tax Act of 1961;

- A “University”, is a university that has been established or incorporated under a Central, State, or Provincial Act, and includes an Institution declared under Section 3 of the University Grants Commission Act of 1956, to be a University for that Act.

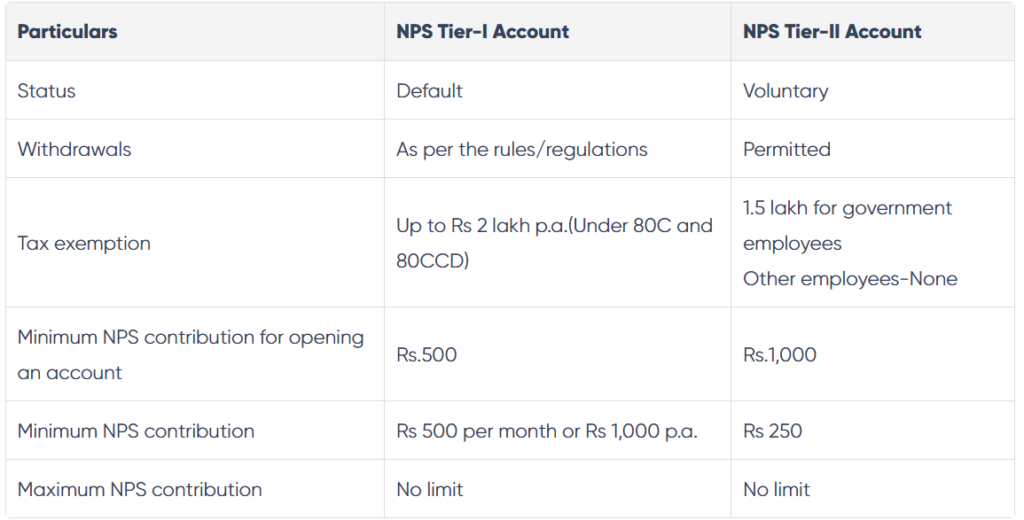

10. National Pension Scheme | One of the must-have options from Best Investment Options in India

NPS is an easily accessible, low-cost, tax-efficient, flexible, and portable retirement savings account. Under NPS, the individual contributes to his retirement account and his employer can also contribute to the social security/welfare of the individual.

NPS is designed on a Defined Contribution basis wherein the subscriber contributes to his / her pension account, there is no defined benefit that would be available at the time of exit from the system and the accumulated wealth depends on the contributions made and the income generated from investment of such wealth.

The greater the value of the contributions made, the greater the investments achieved, the longer the term over which the fund accumulates, and the lower the charges deducted, the larger would be the eventual benefit of the accumulated pension wealth likely to be.

Types of NPS Accounts

The two primary account types under the NPS are tier I and tier II. The table below explains the two account types in detail.

Closing Thought Best Investment Options in India

In the article above, we analyzed the Top 10 Best Investment opportunities in India; however, the Indian market offers a wide range of different investment options.

Avoid trying to get quick money. You could get lucky at first, but there is no shortcut to financial success in the long run!

Before investing your hard-earned money in any investment opportunity, you should thoroughly consider its suitability for your needs.

Also Read: Best Mutual Funds in 2024

To open a Demet Account with Upstox click here

Pingback: BLS E-Services IPO - 100% GMP? | Should You Invest in BLS E-Services IPO? -

Pingback: Entero Healthcare Solutions IPO | 10 things you should know before You Invest in Entero Healthcare Solutions IPO? -